What is a Living Wage?

Explaining how to find and understand an area's living wage

A living wage is simply the minimum hourly amount that a full-time worker must earn to afford basic necessities. In this case, a full-time worker is defined as someone who works at least 2,080 hours a year. Because the costs of basic necessities are so different in different places living wage only makes sense for a particular location. The living wages of a big metropolitan city will be different from those of a rural community.

Calculating a Living Wage

Researchers use different techniques to estimate living wages. Most estimates are based on consumer expenditure data. One of the most well-known and widely-used estimates comes from the MIT Living Wage Calculator. The Calculator uses spending data from national public surveys. The MIT Calculator uses data from nine categories of “basic needs” spending:

- Food

- Childcare

- Healthcare

- Housing

- Transportation

- Civic engagement

- Broadband internet

- Miscellaneous items

- Taxes

The Calculator adds up the annual amount a typical household would need to cover these. This provides a “basic needs budget.” Dividing that amount by 2,080 hours, the MIT Calculator reports a living wage for each county in the US based on that budget.

The MIT Calculator creates budgets for a variety of households based on the number of adults, working adults, and children living there. It doesn’t report a single dollar figure. Instead it presents a range of living wages that illustrate how much they very per county.

We’re talking about the MIT Calculator because not only has it become something of a gold standard, but its “basic needs budget” method is frequently used in other living-wage estimation projects.

As the name implies, a basic needs budget covers a basic or relatively low-cost lifestyle. In practice, this means that most living wage calculations are not done for “typical” (e.g., average or median) spending but for below-average spending habits. For instance, most living wage calculations use U.S. Department of Housing and Urban Development (HUD) data on Fair Market Rents (FMRs) for monthly housing expenses. These FMRs are set at the 40th percentile.

Other Methods

Many researchers use a place’s rental housing wage to approximate a local living wage. According to the National Low Income Housing Coalition (NLIHC), a housing wage is the hourly wage a full-time worker needs in order to afford a basic rental home without spending more than 30% of their gross monthly income on rent. NLIHC computes the housing wage for various locations in the U.S. using the HUD FMR for a two-bedroom apartment. Other groups that use this technique have used the FMR for a one-bedroom unit in their calculations.

Although there is no universal agreement on which rental price to use in the calculation of a housing wage, there is a broad consensus that a wage that enables a worker to spend no more than 30% of their gross income on housing is appropriate. The reason for this 30% is that HUD, as well as the broader affordable housing community, uses that 30% to define the housing cost burden. To be housing cost burdened is to struggle with housing unaffordability and live in a state of precarity. Because a living wage is enough for workers to meet their basic needs without struggling to find financial help, a housing wage is a type of living wage where a worker earns enough to pay for their shelter.

It’s easy to calculate a housing wage from HUD FMR data. It does not require any more data from other basic needs. It only needs one input: the local HUD FMR for the unit type (e.g., one- or two-bedroom) on which the calculation is to be based.

If you’re interested in a more detailed discussion about how living wages can be calculated, take a look at our detailed explainer: Living Wages: a Deep Dive.

The major takeaway is that there is no one, nor one optimal, way to compute a living wage. Which method to choose should be matched to the goals and objectives of their project or campaign.

What are Some Current (2023) Living Wage Estimates in New York State?

Let’s look at a basic needs budget for a single worker living alone with no children in New York State. The MIT calculator gives us a living wage of $21.46 per hour on average (in fall 2023).

(We downloaded the MIT estimates for a single adult with no children for all 62 counties in New York State and computed the weighted statewide average using the size of a county’s civilian labor force as a weight. That gave us a weighted statewide living wage estimate of $21.51 per hour, slightly above the MIT Calculator’s statewide average.)

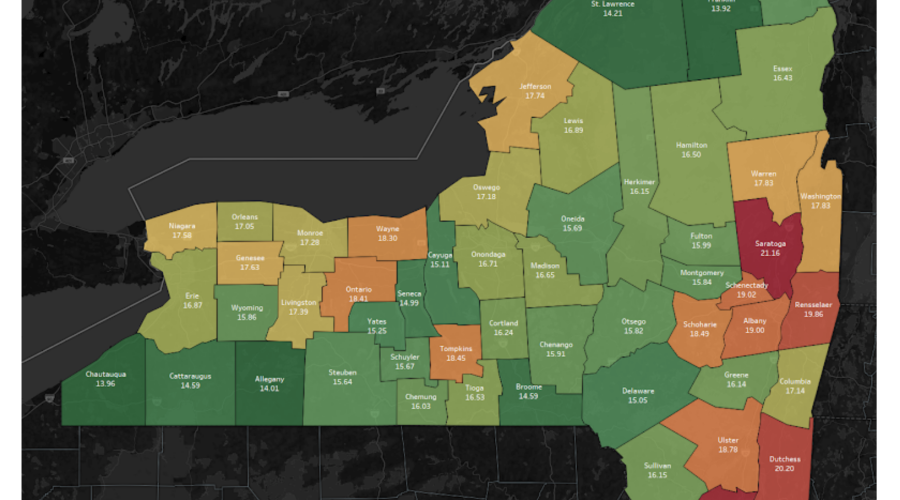

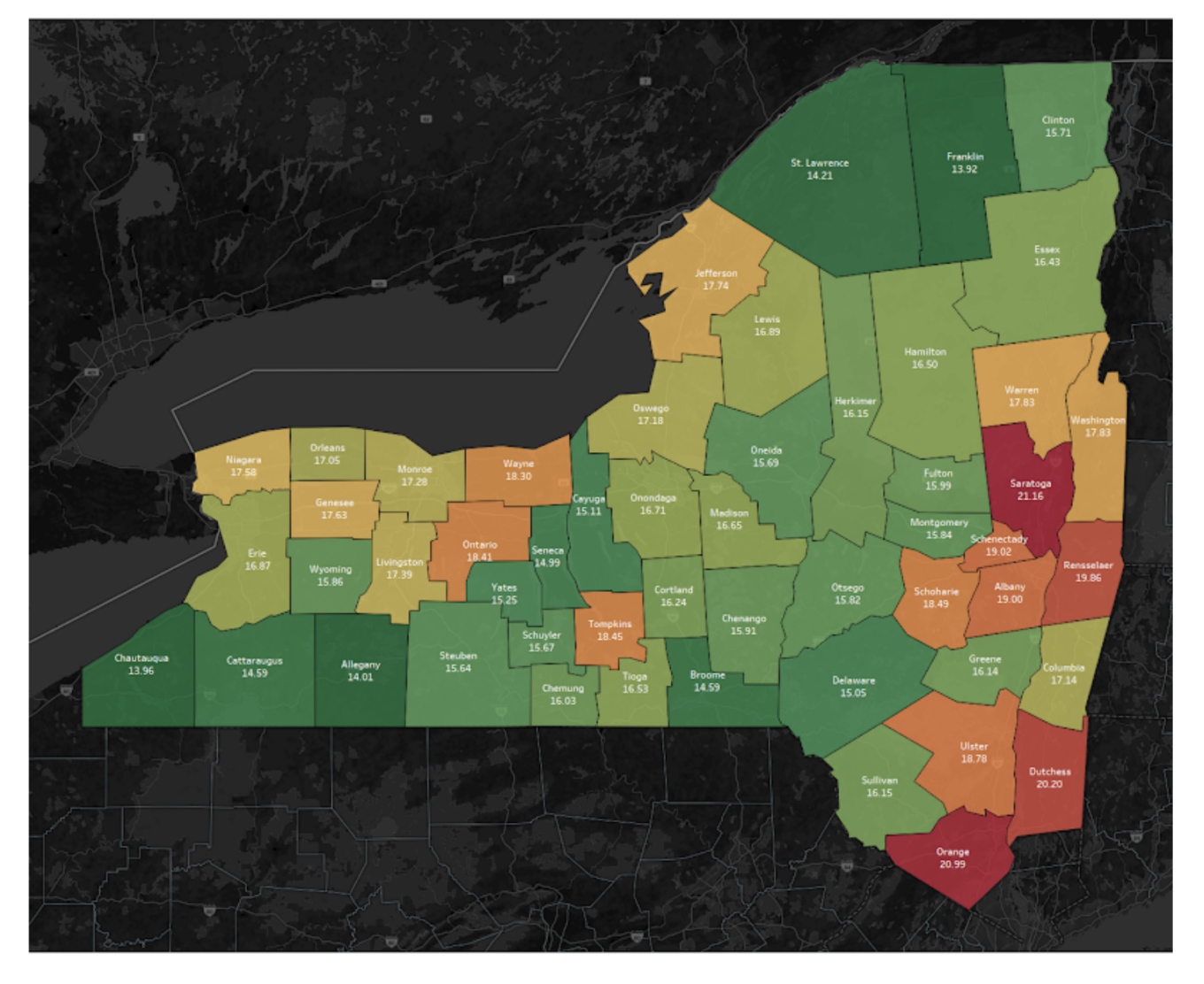

Recently, researchers here at the Cornell University ILR School used a basic needs budgeting method powered by localized, commercial data to estimate living wages for single workers (with no children) in counties in upstate New York. For the purposes of the analysis, “downstate” was defined as the New York City and Long Island NYS Labor Market Regions (LMRs). “Upstate” includes all remaining counties in the state. According to that project, a weighted average living wage for a single worker in upstate NY is $17.47 per hour, slightly higher than the analogous weighted average from the MIT Calculator ($16.38 per hour).

The weighted rental housing wage for a one-bedroom unit, based on HUD FMR data, is $18.08 per hour. Broadening the definition of a housing wage to include housing types other than one-bedroom units, an upstate housing wage from ACS PUMS data was found to be $18.13 per hour. In all cases, the average “upstate” living wage falls well above the current NYS “upstate” minimum wage of $14.20. This shows that the NYS minimum wage is not a living wage for upstate New Yorkers.

Although it is not pictured in the team’s interactive map, which is focused on upstate, the weighted average living wage the team computed for single workers in downstate counties is $28.54 per hour, well above the MIT Calculator’s corresponding weighted average of $24.17 per hour. The HUD-based housing wage for a one-bedroom unit downstate was estimated at $39.86 per hour, compared to a $33.21 per hour housing wage computed from PUMS data. The latter reflects the fact that many single workers living downstate may dwell in lower-cost, zero-bedroom studios compared to HUD’s FMR for a one-bedroom unit. The table below summarizes these statewide, upstate, and downstate living wage estimates for a single adult. In addition to the broad regional estimates, the table includes estimates for Cornell University’s home county of Tompkins.

Comparison of Living Wage Estimates for Selected New York State Geographies

|

Living Wage for a Single Worker Living Alone with No Children |

Cornell ILR Estimate |

MIT Living Wage Calculator Estimate |

FMR-Based Housing Wage |

PUMS-Based Rental Housing Wage |

NYS Minimum Wage as of November 2023 |

|

Statewide |

$24.77 |

$21.46 |

$32.44 |

$28.07 |

N/A |

|

Upstate |

$17.47 |

$16.38 |

$18.08 |

$18.13 |

$14.20 |

|

Downstate |

$28.54 |

$24.17 |

$39.86 |

$33.21 |

$15.00 |

|

Tompkins County |

$18.45 |

$18.47 |

$24.54 |

$22.38 |

$14.20 |

Importantly, the estimates shown in the table above all change markedly when different household situations (e.g., the presence of children, the presence of other adults) are taken into consideration. The MIT Calculator is especially useful for exploring such changes.

Cornell ILR County-Level Living Wage Estimates for Single Workers (Without Children) Living in Upstate New York

So, what’s a living wage?

A living wage is an hourly pay that would allow a full-time employee to meet their basic needs without needing more public or private financial assistance. There are several ways to estimate a place’s living wage, and no one method is universally superior or preferred. Arguably the two most common techniques for doing this work include basic needs budgeting and deriving a place’s housing wage.

When applying these methods to data for single workers (without children) living in New York State, it can be shown that New York’s minimum wage is far from being a living wage.

Regardless of whether they live upstate or downstate, New Yorkers earning the state’s minimum wage are almost certainly not in a position to meet their basic needs without working extra jobs or finding support from public benefits programs.