Digital Currency Plan Would Provide Rapid Payments to Recipients In and Beyond the Pandemic

The social distancing measures necessitated by the COVID-19 pandemic are antithetical to productive activity, including to the pay people earn through productive activity. Economies worldwide are accordingly confronted by simultaneous supply-side and demand-side shocks.

To arrest and reverse these shocks, simultaneous demand and supply side measures must be taken as quickly as possible. This means our capacities to store and to transfer value – to make and receive payments and disburse money – must be sped up as well. In so doing, we will be optimizing not only a pandemic response architecture, but also the payments infrastructure with which we shall all live and prosper long after the present pandemic is past.

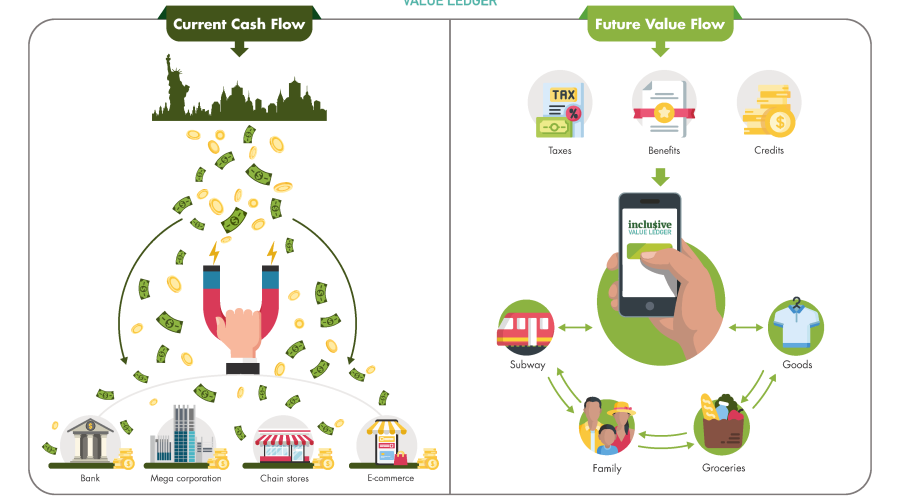

Digital currencies and associated payment platforms are optimal means to the optimization in question. A currency is just ‘that which pays’ in a payments system, hence ‘that which counts’ in a system of value accounting. To design a digital currency is accordingly to design a literal speed-of-light mechanism of value storage and transfer. It is to supply a banking and financial architecture by supplying a commercial architecture, as is always the case in any ‘commercial society’ or ‘exchange economy’ such as our own.

Many U.S. cities and states, as well as the U.S. Congress, are on to this idea. Since late March, Democrats and Republicans in both chambers of Congress have been weighing proposals, including one by Cornell University Law professor Robert Hockett, to legislate into existence a ‘Democratic Digital Dollar’ and associated system of digital wallets.

Professor Hockett’s ‘Inclusive Value Ledger’ Plan is colloquially e known as ‘the Public Venmo plan’ ever since two New York state legislators – Assemblyman Ron Kim and State Senator Julia Salazar – proposed a draft bill to put it into effect. It can be instituted by municipal, state or national authorities, and at the national level, it can be administered either by the Fed or by Treasury.

For reasons rooted in both the ‘need for speed’ and the need for payment system inclusion in the midst of pandemic, states and cities have an opportunity to move forward with this plan irrespective of how expeditious Congress proves in taking it up. To read a sketch of Professor Hockett’s Inclusive alue Ledger Plan in its local, state, Treasury and Fed renditions, visit: https://blogs.cornell.edu/highroadpolicy/2020/07/28/the-inclusive-value-ledger